tax abatement definition for dummies

Most owners of houses will be required to pay property taxes that are commonly from 1 to 3 of the value of the house every year. This relief period frees up a companys capital so that it may be used to purchase.

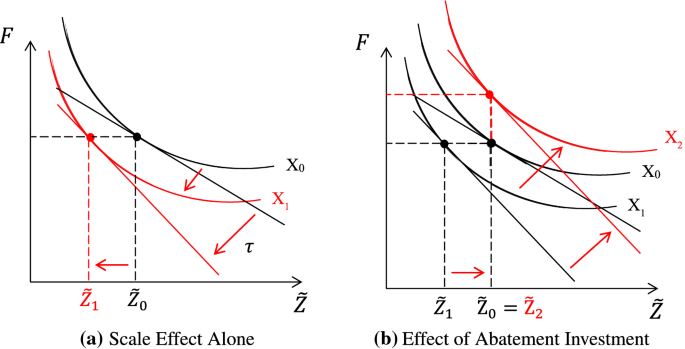

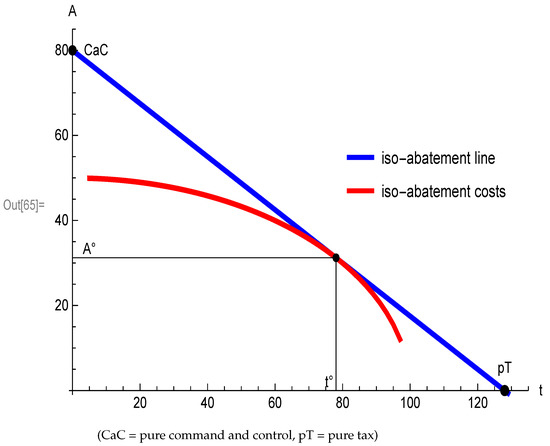

How Do Carbon Taxes Affect Emissions Plant Level Evidence From Manufacturing Springerlink

The difference between a tax abatement and a tax assessment.

. Mayor Fulop signed his abatement policy into effect by executive order on December 24 2013. You can request reasonable cause penalty abatement by writing the IRS. The storm suddenly abated.

77 Tax Abatement Disclosures that will require those state and local governmental entities that offer tax abatements to provide details about the program or programs in the note disclosures. An exemption reduces the taxable value of a property which in turn lowers the taxes owed. Tax abatements help reduce the initial costs of opening a business.

It represents part of the ongoing cost of owning a home. A taxpayer seeking abatement of taxes assessed on property has the burden of proving the disproportionate payment of taxes by a preponderance of the evidence. Tax abatement is a financial incentive for the buyer.

That said the same owner may qualify for a tax exemption on one property and not on another. For example John Doe owns a house and owes 4000 in property taxes for the year. Tax abatement on property is a major savings.

The primary purpose for this new requirement is to provide. Moreover it is something unpleasant or undesirable. Abatement in legal business or financial situations refers to the lessening reduction or ending of something.

Though the basic concept of TIF is straightforwardto allow local governments to finance development projects with the revenue generated by the developmentits implementation can differ in each state and city where it. Property taxes are a common subject of abatement though the term is often used when discussing overdue debt. Check out our property tax calculator.

One method is called tax increment financing. A reduction of taxes for a certain period or in exchange for conducting a certain task. Essentially it means banking on the increase in property tax revenue that will result when the project is finished.

The policy was a clear departure from his campaign pledge which included the promise to allocate abatement revenue to a dedicated non-discretionary account for education funding. Johns house is very old and he is able to have it added to the. A sales tax holiday is another instance of tax abatement.

Tax Abatements 101. The term abatement refers to a situation where an economic burden is reduced. The government can fund a project by pointing to the revenue the project will generate once its complete.

A Property Tax Abatement is essentially an agreement by the city to charge the property owner less in property tax than the owner would otherwise pay without the abatement. Abatement of Debts and Legacies is a common law doctrine. Tax-abatement as a means A temporary suspension of property taxation generally for a spe-cific period of time.

Such arrangements are known as tax abatements. It reduces or completely eliminates the tax on the commercial or residential property. Some organizations offer tax abatement on the properties.

How Does an Abatement Work. This period is typically extended to between 5 and 10 years. An abatement reduces the taxes directly for a specific period of time.

Abatement is a reduction in the level of taxation faced by an individual or company. The most common types of penalty abatement are due to reasonable cause or first-time penalty abatement. Abatement of tax refers to a reduction in or reprieve from a tax debt or any other payment obligation.

If an individual or. For example if one receives a tax credit for purchasing a house one receives tax abatement because one pays less in taxes than heshe otherwise would. This burden might take the form of a debt an import tariff a tax a fine a penalty or a reduction of the percentage being charged like an interest rate or a tax bracket reduction.

This annual expense does not disappear when the mortgage is completely paid. These organizations include municipalities state treasury offices city governments and the federal government. All Tax Abatement Agreements shall require the recipient to construct or cause construction of specific improvements on the real property that is subject to the Abatement.

Penalty abatement removal is available for certain penalties under certain circumstances. The difference is fairly simple. The meaning of TAX ABATEMENT is an amount by which a tax is reduced.

Governments use abatements as an. An abatement is a reduction in a tax rate or tax liability. The verb to abate means to become less intense as in.

They are granted by the city and can provide full or partial relief from property and other taxes for a specified period of time. For example the Portland Housing Bureau says its tax abatement program could save property owners about 175 a monthor about 2100 a yearfor a. State the type of penalty you want removed.

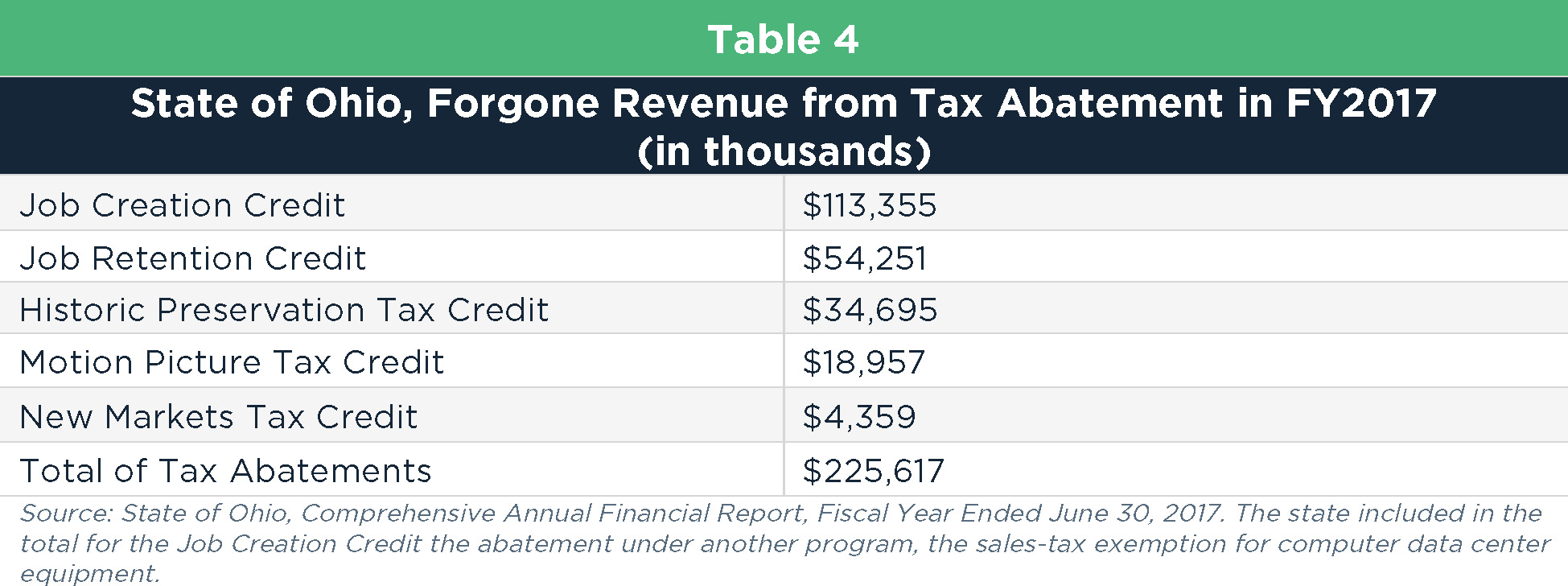

Examples of an abatement include a tax decrease a reduction in penalties or a rebate. Recently the GASB published GASB Statement No. A reduction in the amount of tax that a business would normally have to pay in a particular.

Tax increment financing TIF is a financial tool used by local governments to fund economic development. Tax abatements are the most frequent scenarios where the term is employed and they.

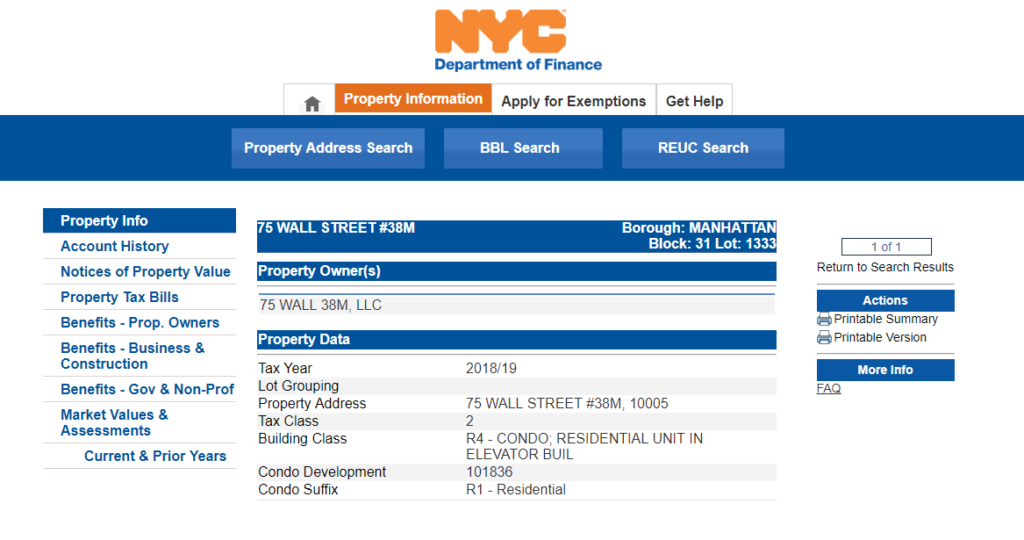

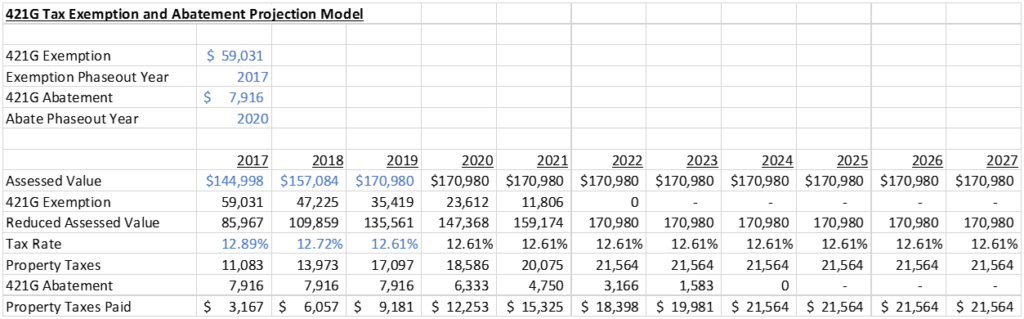

What Is The 421g Tax Abatement In Nyc Hauseit

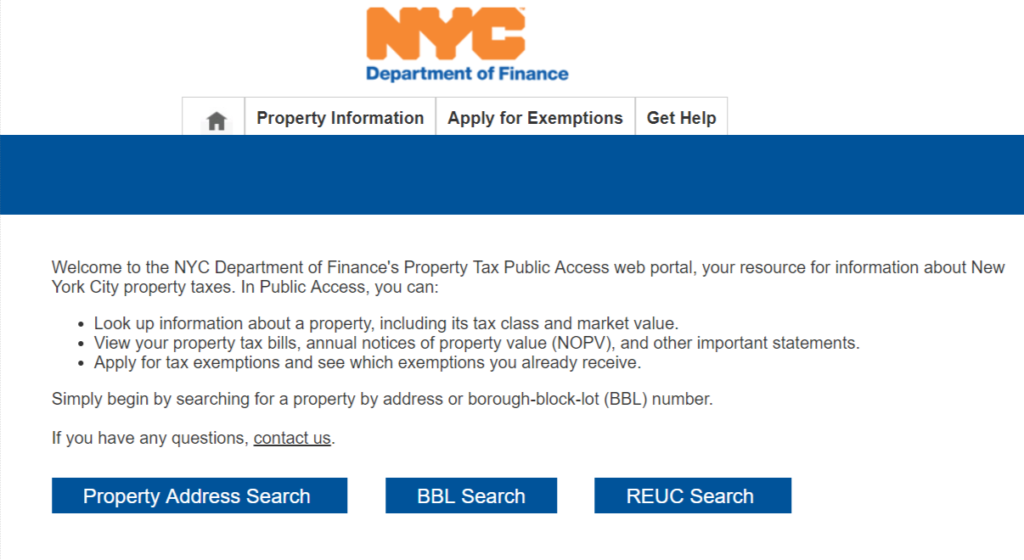

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

What Is The 421g Tax Abatement In Nyc Hauseit

What Is The 421g Tax Abatement In Nyc Hauseit

What Is The 421g Tax Abatement In Nyc Hauseit

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

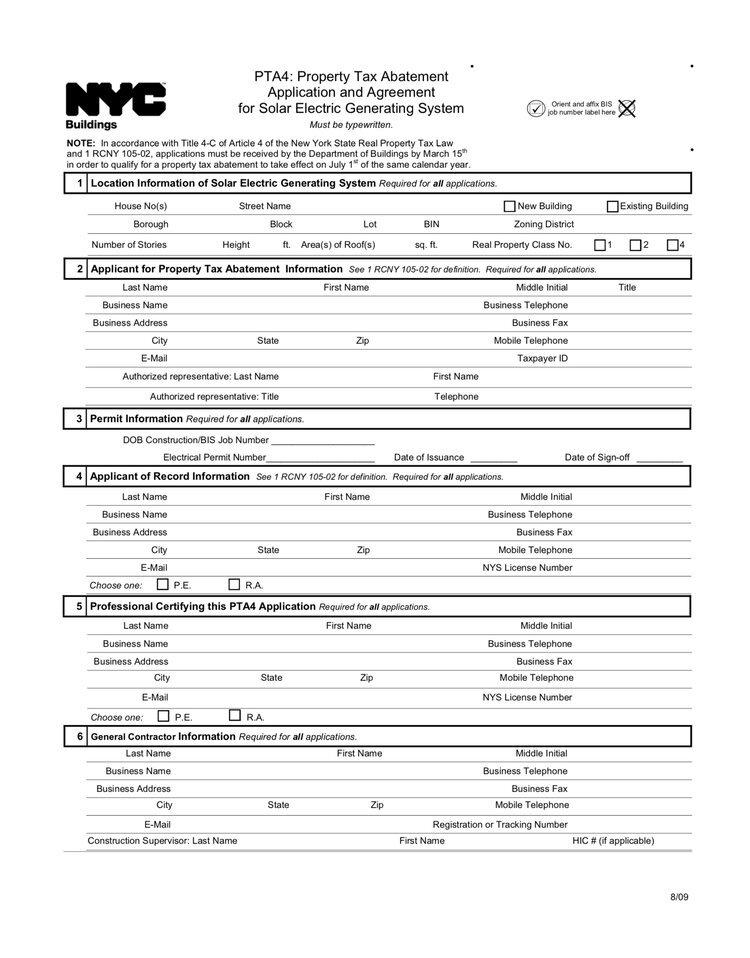

Nyc Solar Property Tax Abatement Pta4 Explained 2022

Define Abatement Definition Of Abatement

Sustainability Free Full Text A Theory Of Optimal Green Defaults Html

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Pdf The Rise Of Carbon Taxation In France From Environmental Protection To Low Carbon Transition

Local Tax Abatement In Ohio A Flash Of Transparency

What Is Abatement Definition And Examples Market Business News

What Is The 421g Tax Abatement In Nyc Hauseit

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo