net operating working capital definition

Net Working Capital is Assets Liabilities - 10000. BBY using the following balance sheets.

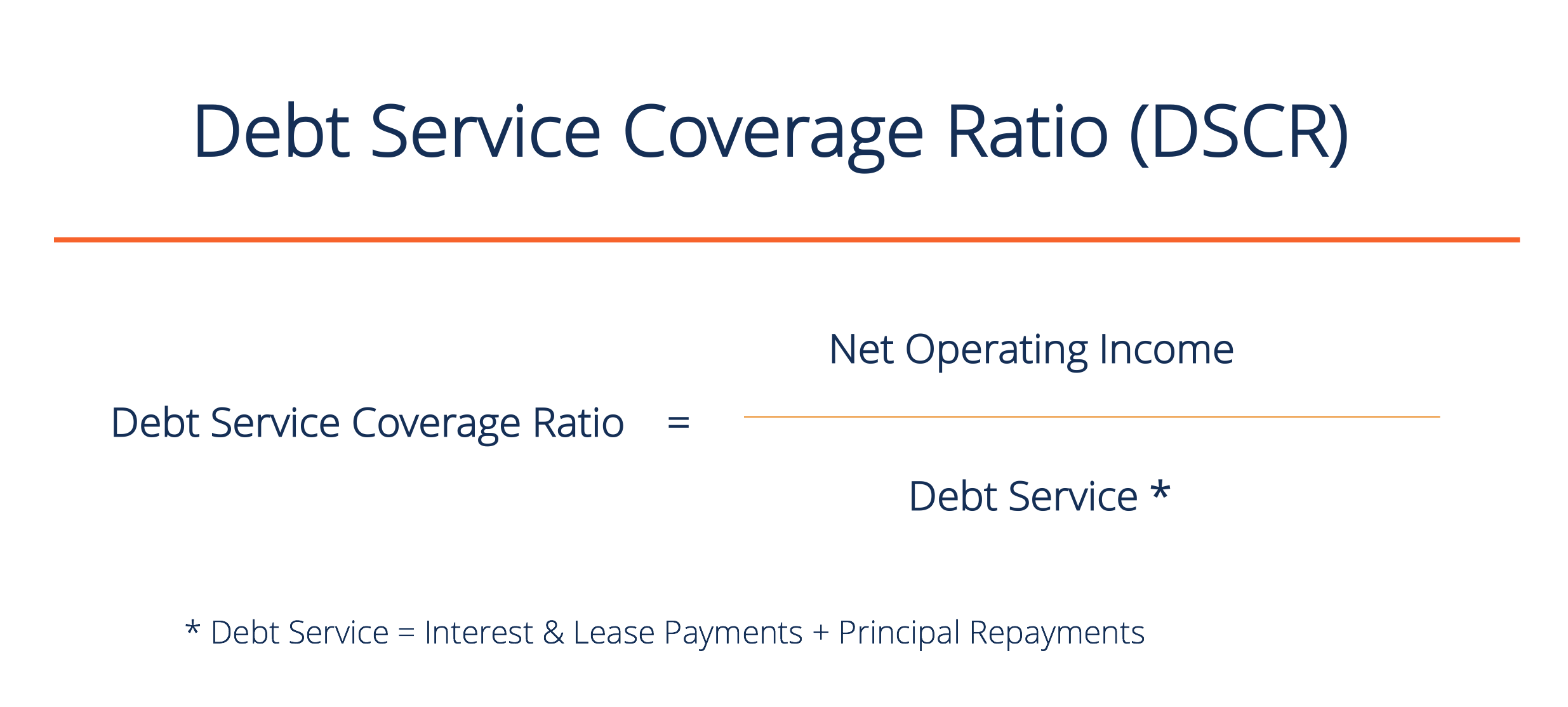

Calculate The Debt Service Coverage Ratio Examples With Solutions

Net Operating Assets are basically the representation of how many assets and liabilities the business has at a given.

. Current assets include cash accounts receivable and inventories and exclude marketable securities. Operating Working capital is a variant of working capital. And How To Calculate It Why is net working capital important.

Simply put Net Working Capital NWC is the difference between a companys current assets Current Assets Current assets are all assets that a company expects to convert to cash within one year. This liquidity ratio demonstrates how able a company is to pay off its current operational liabilities with its current operational assets. Working capital or net working capital NWC is a measure of a companys liquidity operational efficiency and short-term financial health.

It is similar to the basic concept of working capital in that it is calculated by subtracting a companys liabilities from its assets but it more narrowly defines what constitutes those assets and liabilities. Currently the traditaional definition does not include either natural or human capital in. A net working capital formula is an equation that measures a companys ability to pay off current liabilities with assets.

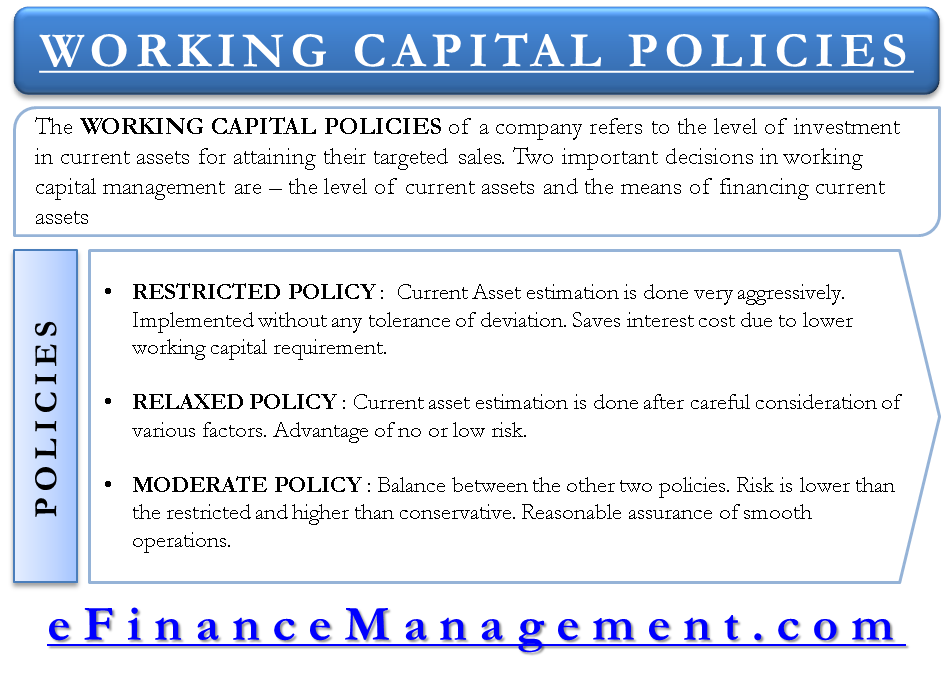

Operating working capital OWC is a financial metric designed to accurately determine a companys liquidity and solvency. It is used to measure the short-term liquidity of a business and can also be used to obtain a general impression of the ability of company management to utilize assets in. Generally net operating working capital is equal to cash accounts receivables and inventories less accounts payable and accruals.

Yes net working capital is the balance sheet difference between a companys current assets and current liabilities but more than that it is a measure of a companys operating liquidity and its ability to meet short-term obligations and fund the operations. The net working capital figure is more informative when tracked on a trend line since this may show a gradual improvement or decline in the net amount of working capital over an extended period. Net operating working capital is defined as non-interest bearing current assets minus non-interest charging liabilities.

Net operating working capital NOWC is the excess of operating current assets over operating current liabilities. What Is the Operating Expense Formula. They are commonly used to measure the liquidity of a and current liabilities Current Liabilities Current liabilities are financial obligations of a business entity that are due.

Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. Net Operating Working Capital Operating Current Assets Operating Current Liabilities Example Calculate total net operating capital for Best Buy Inc. Operating represents assets or liabilities which are used in the day-to-day operations of the business or if they are not interest-bearing financial.

Operating current assets are assets that are a needed to support the business operations and b expected to be. Generally a 21 ratio of current assets to current liabilities is considered to be an adequate. Operating working capital is defined as operating current assets less operating current liabilities.

Net operating working capital is a financial metric that gauges the difference between a companys non-interest bearing operating assets and its non-interest charging operating liabilities. It is simply defined as the difference between the operating assets of the company and the operating liabilities of the company. Once the Net Working Capital is calculated you can scrutinize how you can use the balance whether you want to make improvements in your current business or make other operational adjustments.

Net working capital is calculated by subtracting a businesss current liabilities from its current assets. Net operating working capital NOWC is the difference between a companys current assets and current non-interest bearing current liabilities. Cash and short-term assets expected to be converted to cash within a year less short-term liabilities.

Net working capital is the aggregate amount of all current assets and current liabilities. Current assets - current liabilities net working capital. What is Operating Working Capital.

It is a measurement of a companys liquidity and looks like this. Net Operating Assets can be defined as the assets within a business that is related to the operations of the business. A positive net working capital indicates that the firm has money in order to maintain or expand its operations.

In most cases it equals cash plus accounts receivable plus inventories minus accounts payable minus accrued expenses. Businesses use net working capital to measure cash flow and the ability to service debts.

Change In Net Working Capital Nwc Formula And Calculator

Calculate The Change In Working Capital And Free Cash Flow

Change In Net Working Capital Nwc Formula And Calculator

Working Capital Cycle Understanding The Working Capital Cycle

Fcf Formula Formula For Free Cash Flow Examples And Guide

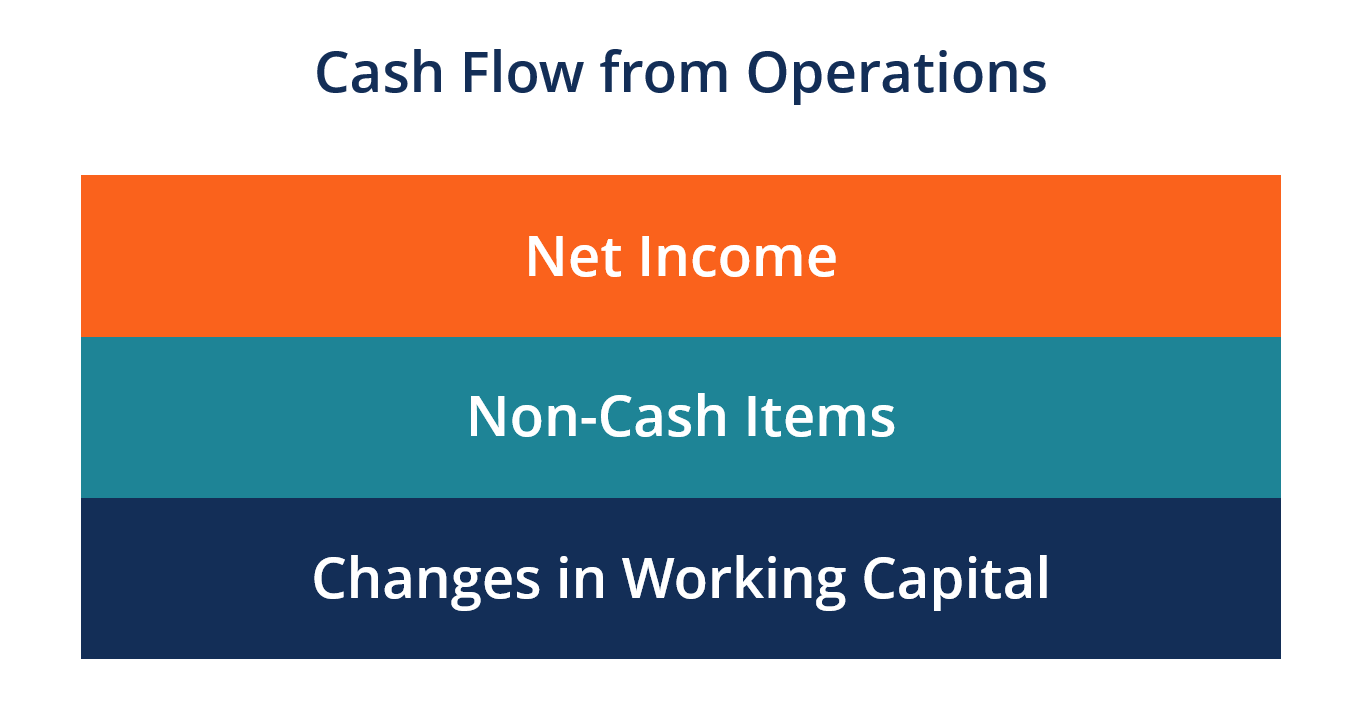

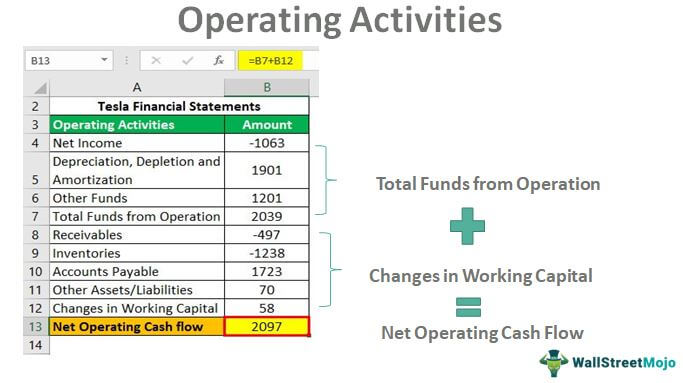

Cash Flow From Operations Definition Formula And Example

Operating Cycle Definition Example How To Interpret

Operating Cash Flow Definition Formula And Examples

Working Capital Example Formula

Operating Activities Definition Examples Why It Is Important

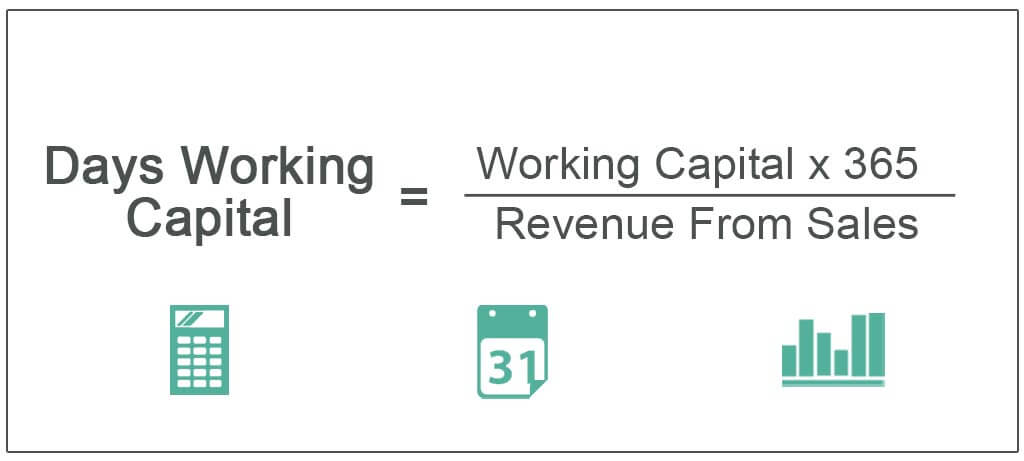

Days Working Capital Definition Formula How To Calculate

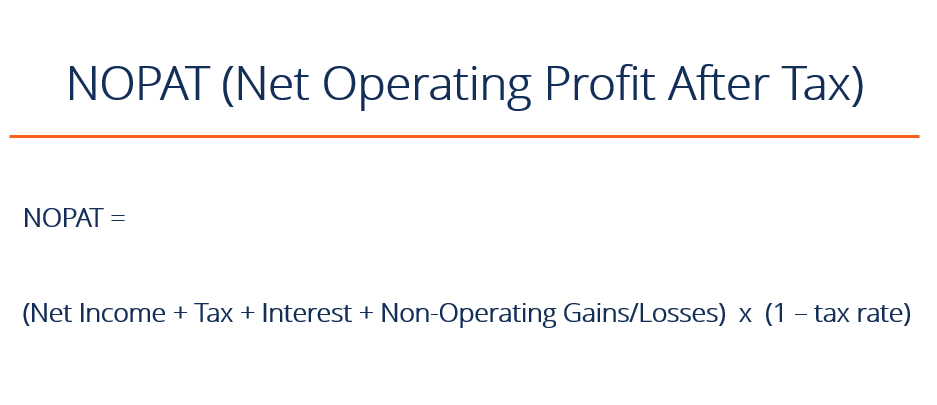

Nopat Net Operating Profit After Tax What You Need To Know

Working Capital Cycle Understanding The Working Capital Cycle

Change In Net Working Capital Nwc Formula And Calculator

Free Cash Flow To Firm Fcff Formulas Definition Example

Working Capital Ratio Analysis Example Of Working Capital Ratio

/WORKINGCAPITALFINALJPEG-4ca1faa51a5b47098914e9e58d739958.jpg)